Introduction to CRA Login Accounts

It is a good idea for all individuals and business owners to set up access to their CRA personal or business accounts. By doing so, you are able to view important information like CRA mail, account balances, apply for benefits, request information, and more. Each individual and business has one account already set up, but perhaps has not accessed by anyone yet. By knowing your CRA account balance, you can ensure that there are no balances owing that you do not know about, and thus keep unnecessary interest payable as low as possible. Each province has their own log in system, so you may have to make an account for each provincial jurisdiction that you deal with.

The link for CRA My Account (individuals) is here. (https://www.canada.ca/en/revenue-agency/services/e-services/e-services-individuals/account-individuals.html)

The link for CRA My Business Account (corporations, partnerships) is here. (https://www.canada.ca/en/revenue-agency/services/e-services/e-services-businesses/business-account.html)

Gaining access to each of these is similar. You can either use the same log in as a “sign-in partner” which includes most major banks or using a CRA username and password. The former is self-explanatory if you have an account, so this blog will focus more on the latter. For most people using the sign-in partner is easier since you do not need to remember another login.

How to Register for an Account

Upon clicking one of the above links depending on your needs, navigate down to CRA Register. The link you require you to enter your social insurance number, which can be found on an old tax return, T4 slip, among others if not available immediately. New Paragraph

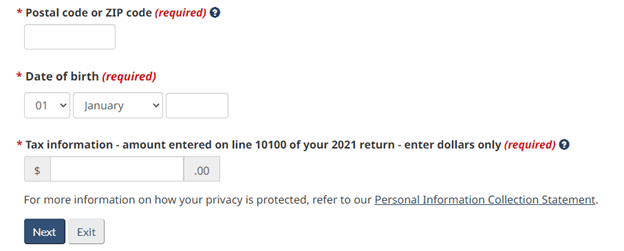

The next step will require you to validate your identity. You will need to enter your Postal/Zip code, date of birth, and information from your last tax return. What they request may change from time to time, but currently line 10100 can be found on your 2021 T1 return and refers to employment income. In the past they have asked for different information from a prior tax return.

After filling this out, the CRA will mail a confirmation code to you; this will have to be entered in order to have access to your account. Your accountant will also usually request access to your CRA account though “represent a client”, as this allows them to view CRA notices, view account balances, update addresses, transfer payments, among others.

You will also have to create a CRA username, password, and some secret questions. The CRA has recently added two-factor authentication, so you must either print out a login grid or provide your phone number for an automated text message. You can also add an email address which will alert you whenever new mail arrives into your account - This in particular is very important since this is how the CRA requests information for audits, which usually have tight timelines.

The next blog will focus on the key features of CRA My Account or My Business Account, and how to ensure you are up to date on important information or your CRA obligations.

Book a complimentary accounting & tax strategy session

St. Arnaud Pinsent Steman CPA

1653-91 Street SW,

Edmonton, AB, T6X 0W8

(780) 448-0399

Business Hours

- Mon - Fri

- -

- Sat - Sun

- Closed

All Rights Reserved | St Arnaud Pinsent Steman