Introduction to Dividends

Dividends

Many people will receive at least one dividend at some point in their lives, and sayings like something will pay big dividends are a part of everyday speech. Dividends in Canada are rather complex and unless they have studied them or had the concept explained to them by an accountant, few really understand them.

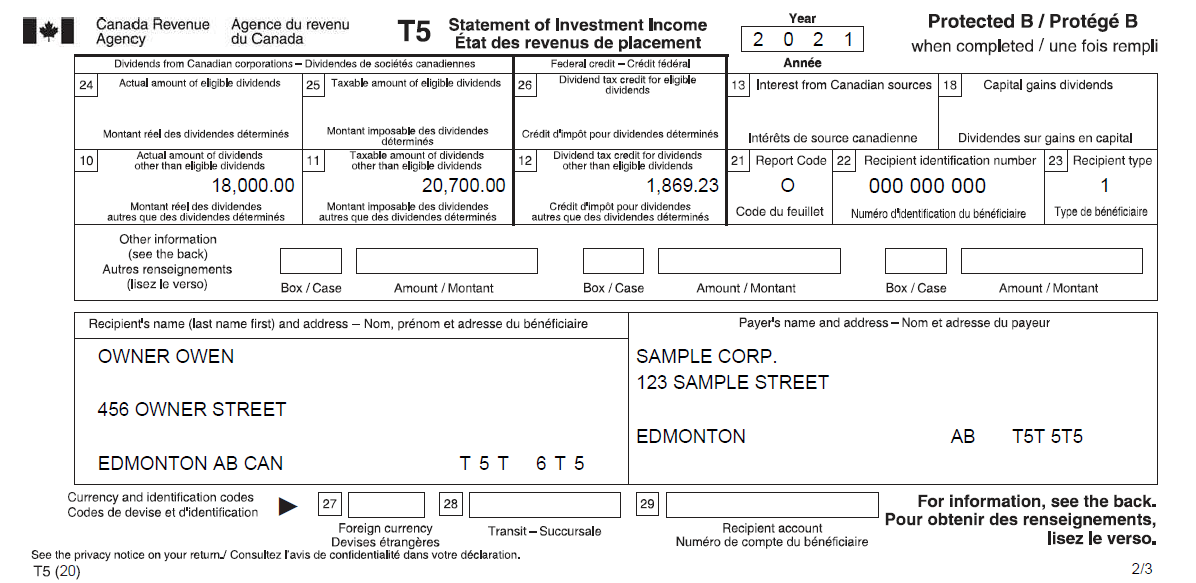

Dividends are reported on a T5 slip, also used for interest, royalties, and other forms of income. We will refer to the above image when explaining how a dividend works. This will focus on small business tax rate dividends, also known as “other than eligible dividends” or more casually as ineligible dividends, but other types of dividends are discussed below.

Box 10 of the above image refers to the actual amount of dividends; this is what would show up on the Statement of Retained Earnings on a set of financial statements. If you have ever followed a corporate dividend from the financial statements though, you will not see the $18,000 number beside account number 12000 of the T1 personal tax return, but rather box 11’s number of $20,700. This is due to the theory of integration where the tax system attempts to make the income from business (dividends) and employment (on a T4) as close as possible. This increase is called the dividend gross-up; the gross-up rate in both 2021 and 2022 is 15%. This sounds like it is punishing to those who take dividends, but read on.

Dividends are paid out from the after-tax income of a Company. Box 12 represents a tax credit that individuals can add to line 40425 of the T1 personal tax return. This is very close to the amount of corporate tax that has already been paid on this dividend, and box 12 ensures that this amount is not taxed twice.

Types of Dividends

Other than Eligible Dividends

When the corporation pays at least some portion of its income at the Small Business tax rate (usually the first $500,000 of corporate taxable income, but there are special cases which change this number), the dividends that it can pay out are other than eligible dividends.

Eligible Dividends

Eligible dividends are when taxes are paid at the general rate. In this case, the gross up rate is 38%, but there is a larger dividend tax credit due to the higher taxes paid in the corporation. Eligible dividends are more tax efficient than other than eligible dividends for personal tax reasons.

Capital Dividends

To understand capital dividends, think about a capital gain recognized personally (example: sale of a stock held personally); only 50% of the capital gain is added to taxable income. When a corporation recognizes a capital gain, a similar thing happens: 50% of the gain is taxed, and 50% is added to the Capital Dividend Account (“CDA”). The amounts in the CDA can be paid out as a tax-free capital dividend at a later date. Note that this is a complex process and you should talk to your accountant for advice on this.

Foreign Dividends

Foreign dividends are reported on box 15 of the T5 slip. Due to international tax treaties and withholding taxes, there is usually an amount in box 16 as well which represents the amount paid to the foreign government. To avoid double taxation, this tax credit will go into line 40500 of the T1 personal tax return as a direct reduction of taxes payable.

Intercorporate Dividends

A corporation can pay tax-free intercorporate dividends to another corporation that holds at least 10% of the votes and value of the first corporation, and as long as the first corporation has enough “Safe Income on Hand.” The calculation of Safe Income is complex, so it is recommended you talk to your accountant before paying out intercorporate dividends.