Introduction to the Shareholder's Loan

What is the Shareholder's Loan?

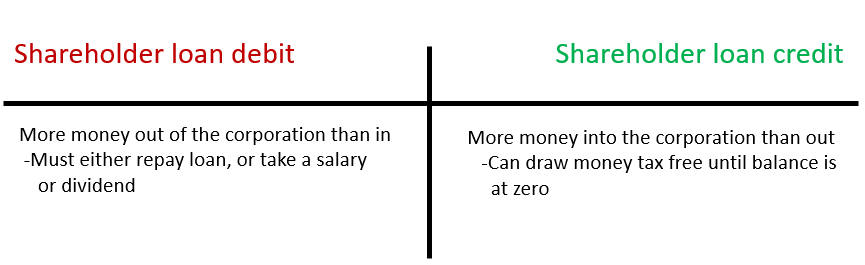

There are rules in the Income Tax Act that prohibit the shareholder loan position from being in a debit position for more than one year, otherwise the CRA will treat it as income not reported. The outstanding amount would have to be added as income in the year it became outstanding (year one of the debit) and taxes will have to be paid. On top of that, there will be penalties and interest from not reporting the income so naturally this is something to avoid. You cannot re-pay the balance the day before your year end and re-withdraw it directly after, since that would count as a “series of transactions” and is disallowed.

What Changes your Shareholder Loan Balance?

Cash withdrawals – Moves to the left in the diagram above (debit)

Payment of personal items with corporate funds – Moves to the left (debit)

Payment of corporate expenses with personal funds – Moves to the right (credit)

Direct cash injection – Moves to the right (credit)

Declaration of salary/bonus/dividend = Moves to the right (credit)

Multiple Shareholders

The CRA rules consider the total shareholder loan for all shareholders. Especially in the case where shareholders are not related, care should be taken to track each shareholder’s draws and contributions to ensure one is not taking advantage of the others. The shareholders should review the shareholder loan at least annually to ensure fairness.

Questions?

The Shareholder loan is a complex topic and planning around plays a large part of minimizing taxes. A professional accountant can help you with an annual plan or with any questions.

Book a complimentary accounting & tax strategy session

St. Arnaud Pinsent Steman CPA

1653-91 Street SW,

Edmonton, AB, T6X 0W8

(780) 448-0399

Business Hours

- Mon - Fri

- -

- Sat - Sun

- Closed

All Rights Reserved | St Arnaud Pinsent Steman